Latest News

Sharon Hospital would become part of a larger regional health systems with 28 hospitals.

Yehyun Kim/CTMirror.org

Nuvance Health, which owns four hospitals in Connecticut and three in New York, will merge with Northwell Health to form a larger regional health system across two states.

Together, the companies will own 28 hospitals and more than 1,000 sites of care and employ 14,500 providers.

“By joining forces with Northwell Health, we are taking a giant leap forward in our shared mission to enhance the quality, accessibility and equity of the health care we provide to our communities,” said Dr. John M. Murphy, president and CEO of Nuvance Health. “This agreement enables us to make significant improvements to health outcomes for community hospitals and to deliver unparalleled care and drive positive change in the health care landscape.”

In Connecticut, Nuvance owns Danbury Hospital, Norwalk Hospital, Sharon Hospital and New Milford Hospital.

Northwell, based in New Hyde Park, New York, owns 20 hospitals.

“This partnership opens a new and exciting chapter for Northwell and Nuvance and provides an incredible opportunity to enhance both health systems and take patient care and services to an even higher level,” said Michael Dowling, president and CEO of Northwell Health. “We have similar missions in providing high-quality care for patients in the communities we serve.”

The deal is still subject to a certificate of need process for state approval in Connecticut and New York, and must also be approved by the Federal Trade Commission. Amy Forni, a spokeswoman for Nuvance, said certificate of need applications are expected to be filed in the coming months.

Nuvance and Northwell officials said the merger will bring greater access to primary, specialty and hospital care through a diverse network of providers. “Northwell will make significant investments in Nuvance Health, helping it continue to evolve as a high-quality and comprehensive health care system,” they said in a statement.

Leaders of both companies said they hoped the merger would create a broader workforce pipeline and expand medical innovation across their facilities.

“Together, both organizations would have the ability to make significant improvements to health outcomes and address health disparities across the communities they serve,” they wrote in a statement. “As nonprofit organizations, Northwell and Nuvance Health would also continue to provide care to anyone, regardless of their ability to pay.”

The Journal occasionally will offer articles from CTMirror.org, a source of nonprofit journalism and a partner with The Lakeville Journal.

Keep ReadingShow less

Keith Boynton, left, with Aitor Mendilibar, right, the cinematographer who shot “The Haunted Forest” as well as “The Scottish Play” and “The Winter House.” In the background of is Vinny Castellini, first assistant director.

Submitted

Keith Boynton is a filmmaker who grew up in Salisbury, Connecticut. He attended Salisbury Central School, Town Hill School, and Hotchkiss. He has made numerous feature films including Seven Lovers, The Scottish Play, The Winter House, and is just wrapping up a new film, The Haunted Forest, which is a horror/slasher movie. Boynton has made numerous music videos for the band Darlingside, and for Alison Krauss. He is a poet, a playwright, and comic book art collector.

JA: This series of stories The Creators focuses on artists, their inspiration, and their creative process. Keith, what was the seed that got you started?

KB: I think the earliest stage of everything is just daydreaming. I’ve been a daydreamer my whole life, probably most kids are. Those daydreams are just daydreams - they don’t come to anything - but occasionally something happens in your imagination that you can’t let go of. Something you want to make real, whether that’s a goal in your life, or a project that you want to pursue, or something you want to create, it just sticks in your mind, and can change your whole life.

JA: Was there a favorite book that you loved growing up?

KB: My favorite book in childhood was The Wreck of the Zephyr by Chris van Allsburg. Some books just fired me up a like Maniac Magee, by Jerry Spinelli, an amazing book that was probably the most exciting thing I’d ever read up to that point. I remember finishing it and just sprinting up and down the driveway. I loved all the William Steig books, especially Dominic. Some art forms lend themselves to the imagination. One of the things I love about cartooning (I’m a huge comic book fan, and I collect comic book artwork) I love the way it can be anything. It is the unfettered exercise of the imagination, whereas making a live action film is a very fettered exercise of the imagination. You are bound by the technology and the reality of what you’re shooting, and the limitations of what you have available, so it’s still a creative act, but it’s not the kind of thing you can just daydream on the paper. You must contend with a lot of reality on the way to making that dream something real.

JA: Why do you love language?

KB: I mean, words are magic. They can create whole worlds. I‘ve always been fascinated by them. There’s nothing more human than the urge to communicate, but words do more than communicate; they conjure. It’s a hell of a thing.

JA: You cannot escape the business side of filmmaking. How do you handle all that, financing, promotion, deal making, streaming, film festivals?

KB: It is a job in itself. The mindset of promoting a film is the opposite of making one. It’s rare to find one person who’s good at both. I want the film to be successful, yet don’t see myself as a marketer. When I am forced into that role it’s an awkward fit. I love the response of an audience. I love watching a movie with an audience, or even better being in front of an audience, that immediate kind of connection. The relationship that you have with anyone in the business of curation of a Film Festival, or a studio executive, lacks immediacy. Yet you must not become an artist who thinks they’re entitled to an audience, or entitled to a platform, or entitled to be regarded as special. Audience members who grant you their time are giving you a gift, which is often unearned.

JA: Do you control the editing process?

KB: I edit my own films, I direct them, and I write them. I’m steering the ship to a certain degree at every stage which is gratifying.

JA: How do you cast your films?

KB: For some films I have used a casting director. For The Haunted Forest, the slasher film that we shot in the fall in Maryland, that is just wrapping up, I was the casting director myself. My first time working without a casting director in probably a decade. It was far more work than I realized. There were 38 speaking roles and I had to piece them together for my people to submit it on the Internet, to attract people who lived in the area. Some were actors, some were not, some from New York, some local. It was an incredible hodgepodge of people some of whom had never acted before, and some phenomenally accomplished actors.

JA: Tell us about The Haunted Forest:

KB: Cousins on my dad’s side, the Markoffs, live in Montgomery County, Maryland. They’ve been operating this haunted forest for about 30 years on their property, creating scary tours in October where you walk through, and people jump out and frighten you. It is like a homemade, horror film Disneyland. I was blown away by the scope of it, the scale of it plus the attention to detail and just the passion that they put into this place. My brother Devin McEwan [slalom canoeist, gold medalist 2015 Pan American Games, medalist 2016 Olympics] had the idea to set a film there. He conceived of the story idea. We developed the screenplay together. Great shout out to my brother without whom this movie would never have been dreamed of, much less brought into being. It’s a story about a young man passionate about horror and Halloween. He gets a job at the Haunted Forest, loves his job, meets a girl, then people at the Forest start dying for real and no one knows why. It is a murder mystery, slasher thriller which is not my wheelhouse as a filmmaker, or even necessarily as an audience member, but I had so much fun making this. The film still has a certain romanticism, maybe more than previous films. The genre is larger than life. There’s darkness and terror, but also the opportunity for heroism and overcoming. I think some of the most cinematic stuff that I’ve ever captured is in this movie. We are close to locking the picture edit, and then after that we sign color, music, visual effects and it’ll be ready to premiere at the actual Haunted Forest this fall. Anyone in the DC area, come watch this movie on site and get scared out of your minds.

JA: Were the special effects challenging for you and for the actors?

KB: I had a steep learning curve. We brought in a special effects expert. Some actors were covered in blood, and it was cold at night, yet the vibe on set was amazingly good, people had so much fun. While most of my films are realistic there’s a certain attraction to melodrama. I want to be fantastical, operatic, yet feel grounded and human and real. If you can pull that off, that’s magic.

JA: How can people watch your films?

KB: Three of my movies, Seven Lovers, The Scottish Play, and The Winter House – are available on Amazon and Apple TV. The best way to keep up with me is facebook.com/TheKeithBoynton, and crazylakepictures.com

JA: Your favorite films and directors?

KB: It’s a Wonderful Life, The Sting, Back to the Future, Point Break. Frank Capra, Christopher Nolan, Martin Campbell, Steven Soderbergh.

JA: Relationships feature in your films, and music videos. Does that come from your own well of experience?

KB: I did grow up in an incredibly warm family, incredibly welcoming, supportive, creative, funny, eccentric. I had a pretty idyllic childhood. [Keith’s father Jamie McEwan was an author and medal-winning Olympic slalom canoeist. Keith’s mother Sandra Boynton is an illustrator known for her iconic, delightful creatures and designs] That does stay with you forever. Optimism is one of the gifts the arts can give us when we need something to hang on.

JA: Tell us about your friendship with the band Darlingside.

KB: I’ve known Don Mitchell since he was little. We grew up together. We used to play the Legend of Zelda in his mom’s basement. Later, after hearing their brilliant music, I offered to make some music videos. I have used their music in my films. They are the loveliest people, so sweet, so committed to what they’re doing. They are really four of my favorite human beings in the world.

JA: Your film The Scottish Play, was just shown on Channel 13 as their Valentine’s Day romantic offering. How did you write so many lines of iambic pentameter?

KB: I have always been interested in Shakespeare’s time. I did some Shakespearean acting as a child. The language is extraordinary, alien yet familiar. It does create a different world, a heightened world, a romantic world, something you can indulge in, escape into, so for a long time I wanted to find some way to play in that sandbox of Shakespearean language. I conceived of the idea of having Shakespeare appear as a ghost because then it can be a contemporary story and Shakespeare can be anything that I imagine. He doesn’t have to be tied to his own biography or anyone else’s version of Shakespeare. I can just write him any way I choose. That movie came out of my desire to synthesize the real and the fantastical.

JA: Do you prefer making independent films?

KB: One of the reasons I toil away in the indie world is because I relish the control. My work can be ignored but it can’t be stopped, or changed, influenced by anyone, which is why I direct my own scripts instead of trying to sell the scripts. Screenwriters have no control over what happens to their screenplay. I was a writer first and foremost. [Boynton has an MFA in playwrighting from Columbia]. I had to learn to direct movies because that’s the only way to protect and make sure the story gets out in a way that you feel comfortable with.

JA: You are a romantic at heart, true?

KB: Romance is a recurring theme in my work, although not so much in my life, and maybe those two things are related. It has been a preoccupation of mine since childhood. My very romantic view is a great engine for stories. I do have a small pipeline with my own poetry on Facebook where I can reach a small number of people very quickly. I wish I could scale up a film pipeline, and I knew just how to reach that audience with that same level of immediacy. It would be an extraordinary feeling, so liberating creatively. Sometimes it is so hard to get up the energy and enthusiasm to begin a new project, when so many things that I’m proud of have been orphaned, forgotten, or fallen on deaf ears.

JA: How do you gauge the success of a film?

KB: There are three categories of response: people that I know which can be gratifying, I sometimes hear from professional critics, and then sometimes a random stranger stumbles upon the movie and loves it. Sadly, the scale of money, time, and energy that goes into a film does not always correspond to the to the scale of the impact.

JA: Do you love filmmaking enough to be satisfied despite a lack of response?

KB: I love being on the set. It is only two weeks out of every two to three years, but I love that feeling of working together.

JA: What’s next?

KB: I’m gearing up to another movie in September and that’ll be shot here in Salisbury, maybe at Mt. Riga. It will be about 10 months between shooting one feature film and another. The film is broadly in the category of horror or psychological thriller. More about mood and character and fabulous actors. I’m going to reuse some of my favorites from people who maybe had a smaller part in my other films.

JA: You describe your work on your website: “it’s humor and a touch of optimism. also, we like coffee.”

KB: I think coffee is one of the core principles of life. It’s certainly a major theme in my work. I think every play or movie contains at least one reference to coffee and usually a very loving reference. It’s a touchstone, but also maybe it represents warmth and comfort.

JA: What do you love about filmmaking?

KB: The camaraderie, the moments of magic, the sense of capturing something special and unrepeatable, the sublime irrelevance and absurdity of the whole endeavor, the excuse to drink endless cups of coffee, those occasional moments when you whisper to yourself (or to someone else): We’re making a movie. (And you are.)

Keep ReadingShow less

Arlo Washington in a film still from the Oscar-nominated short "The Barber of Little Rock."

Story Syndicate

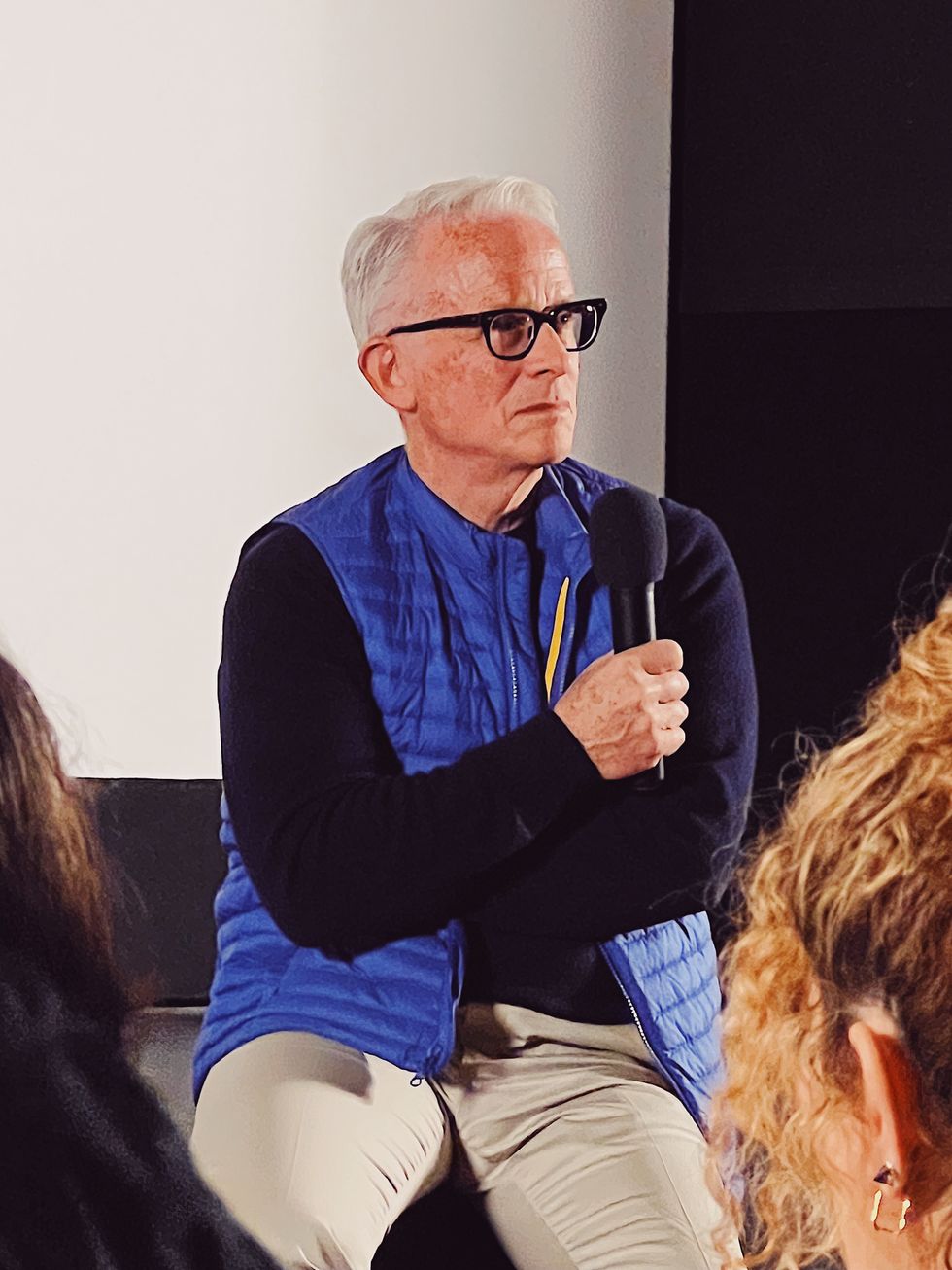

John Hoffman, a Millerton resident, has been nominated for his film “The Barber of Little Rock,” which he co-directed with Christine Turner, in the Best Documentary Short Film category at the upcoming 96th Academy Awards.

Distributed by The New Yorker and produced by Story Syndicate Production in association with 59th & Prairie, Better World Projects, and Peralta Pictures, “The Barber of Little Rock” explores the efforts of Arkansas local hero Arlo Washington, who opened a barbershop at 19 years old and, with a mission to close the racial inequality gap in his community, went on to found the Washington Barber College as well as People Trust Community Federal Credit Union. Washington’s goal is aiding his primarily Black neighborhood, which has historically been underserved by more prominent banking institutions.

Hoffman appeared at The Moviehouse in Millerton for a special screening of the short film Friday, Feb. 23, which played along with the four competing nominees: “Nai Nai & Wài Pó” (Grandma & Grandma), a humorous portrait by Sean Wang of his maternal and paternal Taiwanese grandmothers who share one home in Los Angeles, California; “The ABCs of Book Banning,” which features interviews with Florida school children discussing the books that have been removed from their libraries; “The Island Inbetween” which documents life on Kinman, an island governed by Taiwan and located across a bay from Mainland China; and “The Last Repair Shop,” about the lives of four dedicated craftspeople who repair the musical instruments for public school children in Los Angeles.

“The Barber of Little Rock” received the Jenni Berebitsky Legacy Award at the 2023 Indy Shorts International Film Festival and was nominated at the eighth annual Critics Choice Documentary Awards.

At the talk, Hoffman explained that one of the most potent experiences in filming the documentary was seeing firsthand the financial and racial divide in Little Rock, illustrated by Interstate 630, which acts as a barrier between white affluence and Black poverty in the city. The interstate resulted from the signing of the Federal Highway Act by President Dwight D. Eisenhower, then the most extensive public works program in America. In the documentary, Scott Green calls the fallout from the I-630 “not a wealth gap, but a wealth chasm.” Green is the nephew of Ernest Green, one of the Little Rock Nine, the first African American students permitted to enroll at Little Rock Central High School.

People Trust, the only Black-owned Community Development Financial Institution in Arkansas, is attempting to bridge that chasm by supporting the emergence of minority-owned businesses in the community, including helping graduates of Washington’s barber college forge a path toward establishing their own shops and salons and providing emergency grants for Little Rock residents experiencing the strains of houselessness or searching for a new start following incarceration. The average People Trust loan is $5,000 for businesses and $1,000 for individuals.

As Washington says in the documentary short, “Once [Little Rock residents] can put funds here, and deposits, then we’re not going to put money outside of this community, we’re going to put money back into the community.”

“Once this catches on, it becomes a threat,” Green replies. “Because it can inspire others to think that they can become free. This is about being free.”

The 96th Oscars will be held Sunday, March 10, at the Dolby Theatre in Los Angeles and will be televised live on ABC.

“The Barber of Little Rock” is available to watch on www.newyorker.com and The New Yorker’s YouTube channel.

Keep ReadingShow less

Inside Troutbeck's kitchen

Feb 28, 2024

Chef Vincent Gilberti

Courtesy of Troutbeck

About growing up in Carmel, New York, Troutbeck’s executive chef Vincent Gilberti said he was fortunate to have a lot of family close by, and time together was always centered around food.

His grandparents in White Plains always made sure to have a supply of cured meats, olives, cheeses and crusty bread during their weekend visits. But it wasn’t until his family moved to Charlotte, North Carolina, when he was 16 that his passion for food really began. It was there that he joined the German Club, whose partnership with Johnson & Wales University first introduced him to cooking.

During high school, Gilberti also worked at a Greek restaurant as a host, dishwasher and line cook. The appeal, he said, was the sense of camaraderie with the fellow line cooks and the friends he made that he couldn’t have met in high school. He valued what it took for all these people to come together to create a meal.

“As a kid, you don’t think about all the moving parts,” Gilberti said. “As I got older and worked in the restaurant, I had a better understanding of the total experience the restaurant provides — it’s not just the food, it’s not just the atmosphere, it’s everything coming together to create a complete experience.”

After high school, Gilberti attended the French Culinary Institution in Manhattan. He chose the accelerated program because although he got a lot out of school, he knew the real learning took place on the job. After graduating, he worked at Keith McNally’s Pulino’s for three years until leaving to be a part of the opening team at Dover in Brooklyn, where he worked his way up from line cook to sous chef.

From there, Gilberti joined his mentor, Walker Stern, at the restaurant Battersby, for what Gilberti described as the highlight of his career so far: “It was a very special moment for me to work hand in hand with Walker. In most restaurants, you don’t have that direct relationship with the chef. It greatly expanded my horizons and really helped me push the limits with my skills.”

Next was Michelin-starred Clinton Hill restaurant The Finch, where Gilberti joined chef Gabe McMackin. McMackin was also establishing himself at Troutbeck and eventually invited Gilberti to make the join him there as the chef de cuisine.

“I respected and admired Gabe and his philosophy, so I obliged and came to Troutbeck,” said Gilberti. After a brief sojourn at contemporary Italian restaurant SPQR in San Francisco, Gilberti was invited back to Troutbeck to be its executive chef.

Anna Martucci: What, besides your working relationship with chef McMackin, attracted you to Troutbeck?

Vincent Gilberti: The property is extremely special and has a deep-rooted history, and I saw the opportunity that it held. I really admired and respected the owners and their mission and goals and what they wanted to accomplish. They are very much a part of and active in the community here. Not everyone chooses to run their business trying to support the businesses around them, but that is very important to Troutbeck. I also knew it was a great opportunity to learn I had never been a chef for a hotel before and had to quickly learn the ways of navigating weddings and banquets.

AM: In what ways do you use your role as chef to connect to the Hudson Valley community?

VG: In every possible way I can, I try to work with as many local farmers, purveyors and producers as possible. I can’t say that I’m sourcing everything from the Hudson Valley, because I do have to rely on outside sources, but as much as possible, that is the goal. The other goal, which is in the Troutbeck mission statement, is zero waste. I try to use every little thing that I can out of everything we acquire.

AM: Why is connecting to the community important to you?

VG: I’m always thinking about how I can meet other individuals, like-minded or not, in this community and how I can support them in ways that are beneficial for everyone. I want to see every business in this community succeed. We can all work together to make the Hudson Valley what it is. Together we can attract people to this area to experience what we have to offer. I want to help make people realize how special this community is and reflect on the people that are here and make them feel special.

AM: What would you say your specialty is?

VG: People always ask me that, but it’s not about one specific thing for me — I have a lot to bring to the table. I will say, however, that one thing that I’m very passionate about is pasta. It was a passion created at Pulino’s and finessed at Battersby with Walker Stern — he is a savant.

Here at Troutbeck, we will sometimes have three to four different pasta dishes on the menu depending what is happening that week. We are thinking about doing a community-night dinner of pasta dishes, in a way trying to create my Sundays at grandma’s with a beautiful salad, antipasto, housemade bread, and a few pasta options. We have the reputation of being expensive, and there is a cost associated with trying to use local businesses, but I also want to be accessible to people who don’t necessarily want to spend $50 on an entree. We want it to be high quality but still affordable, because the mission of Troutbeck is to be inclusive of the community.

AM: How has the Hudson Valley farm-to-table food scene grown and changed during your lifetime?

VG: Growing up, the farm-to-table establishment wasn’t a thing. In the ‘90s, people were more concerned with quantity over quality. I’ve seen a significant shift of people being more cognizant of what they are eating. They want to know where the steelhead trout is from — is it farmed or is it wild-caught? I see that as the biggest shift, but there is a high cost in that. I see my job as making farm-to-table food be inclusive because I want people in the community to feel comfortable coming here and enjoying what we have to offer.

AM: What would you like to see more of in the agricultural community in this area?

VG: We already have an establishment of great local farms — I’d love to see more of them so we can continue to support the community. I have this opportunity to work with all these people who are just as excited about food as I am. Continuing to build relationships with local farms and the community and sharing it with the guests that come through the door — that is what I am most excited about.

AM: What do you love most about this area?

VG: I really like being away from the hustle and bustle of the city. It’s nice to be surrounded by nature, it’s nice to be able to go out on hikes. In my personal time, I love to forage and try to make something out of things I find that people wouldn’t normally eat. Come May, you will find morels and ramps all over the Troutbeck property. And I like to cook for my friends.

AM: What do you most appreciate about working at Troutbeck?

VG: The people. It takes an army to do what we are doing here. And I think, across the board in every department we have, everyone has a mutual respect for one another. At any given moment I can call on someone and they will be there for me. It has become a second family for me. I feel special to work with a group of individuals who support one another and have each other’s backs. This article is about Troutbeck and Vinny, but it is so much more than that. I couldn’t do this without the people in the kitchen who support me. There are so many people that it takes to make this happen for everyone and I really just admire them all and I can’t thank them enough. I’m grateful to have every single person on this property.

Keep ReadingShow less

loading